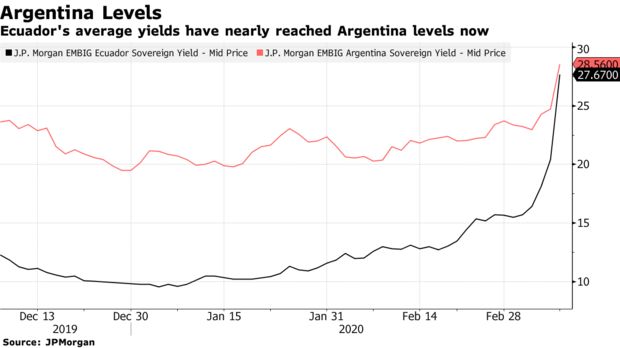

Ecuador Yields Surge Above 20% as Oil Rout Boosts Default Risk

Published on March 12, 2020

Facebook Twitter Google+ LinkedIn Ecuador’s dollar bonds have slumped as investors price in a higher probability of default following the crash in crude oil prices. The nation’s dollar bonds due 2028 fell 10.6 cents, to 47.6 cents on the dollar on Monday, sending the yield surging 4.3 percentage points to 22.3%. The extra yield investors […]

More from this issue

Wow, a lot has sure happened in the week since my last column. And a lot more will happen before this week’s edition hits the newsstand. I’m talking about the coronavirus of course. Things are moving so fast that almost anything written today will be outdated by tomorrow. That’s both good and bad. It means […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

CRIME AND ACCIDENT REPORT

Cuenca and National Criminal Activity (Ecuador) Police dismantled a dangerous gang that operated in three provinces of the country committing robberies of financial entities and armored vehicles and launched armed assaults. The operation to arrest these criminals was called “Gran Victoria 06” and was carried out in the provinces of Manabí, Pichincha and Santo Domingo […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

Embassy officials trying to help Canadian reportedly roaming Galápagos Islands

Officials in Ecuador are attempting to help a Canadian man in the Galápagos Islands who locals say has been seen wandering and behaving aggressively. On Friday, an official at the Canadian Embassy in Ecuador said they were aware of reports about a Canadian man on San Cristóbal Island, the easternmost island in the Galápagos archipelago. […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

Galápagos Islands activate plans to prevent the entry of novel coronavirus to the archipelago

The Government of the Galápagos Islands, an Ecuadorian archipelago considered a world heritage site, has activated a plan to prevent the arrival of the coronavirus to the islands without harming tourism. Norman Wray, head of the Galápagos Governing Council, confirmed the activation of a plan that will intensify controls inside and outside the islands. “We […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

Domestic exports being impacted by coronavirus in China and beyond

The spread of the coronavirus throughout China (and the rest of the globe), has led to reductions in the export of Ecuadorian goods to the Chinese market. On Tuesday, the Government met with representatives of the productive, logistic and commercial sectors of the country to review the impact that this disease has on internal and […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

Minister of Finance says economic measures announced by Ecuador would have a positive impact of $2.252 billion

Ecuador’s Minister of Finance, Richard Martínez, said that with the economic measures that the Government has proposed, a positive impact of some $2.252 billion could be obtained. The greater amount has to do with the reduction of expenses in goods and services and capital goods that account for about $1.38 billion. At a press conference, the […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

Argentinian killed in Ballenita had multiple skull fractures

An Argentinian who was missing for several days was found dead Tuesday night in a septic tank sealed with cement, at the home she was renting in Ballenita, a town in the province of Santa Elena, in eastern Ecuador. The preliminary autopsy report indicates that Gabriela Andrea Pedraza had multiple skull fractures and evidence that […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

Guayaquil to limit motorcycle travel to one person overnight

In response to the increase in robberies being perpetrated by pairs of criminals on motorcycles, Guayaquil has instituted a new measure restricting motorcycle travel to one person during select hours of the evening and nighttime. To provide safety for its citizens, the National Police will focus its controls and increase patrols during the indicated hours, […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

A dark secret hides in the Museo Pumapungo

Many of Cuenca’s residents know of Pumapungo museum and think they’ve seen everything it has to offer. Pumapungo is home to a world class collection of art, artifacts, and more than 20 displays that illustrate the variety of Ecuador’s geographic regions. But for many visitors, the main draw is the museum’s collection of shrunken heads […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

Digital Marketing Workshop to be held in Cuenca

If you’re looking to raise your online presence or to bring more exposure to your business, there will be a “Social Media Strategy Workshop” held on March 21st and 22nd in Cuenca. The meeting will bring together experts in the management of the internet and online businesses. Brent Hoberman, creator of LasMinute.com, says that for […] To view this article you must have an active subscription. Already a member? Sign in. Subscribe to weekly reports on Ecuador’s economics, politics, crime and more. Not sure you want to commit? Don’t worry, you can cancel anytime. For a limited time,subscribe now and get your first month for only $1. Regular subscriptions available at $4.99/month or $42/year. Subscribe now!

0 Comments