The financial cost of Ecuador’s foreign debt has fallen since 2019, however domestic debt obligations are becoming more onerous.

The average interest rate on Ecuador’s public debt stood at 3.99% in February 2022. This is the lowest indicator since 2019, when the financial cost was 6.16%.

The fall occurred due to a reduction in the average interest rate on foreign debt, which went from 6.2% in December 2019 to 3.2% in February 2022.

One of the reasons was the renegotiation of the debt tranche in Ecuadorian bonds, which took place in August 2020.

At that time, the country managed to reduce the original capital of the debt in Global bonds from $17.375 billion to $15.835 billion.

Ecuador also achieved a reduction in the average interest rate on these titles, which went from 9.2% to 5.3%.

Another factor in the reduction in the financial cost of foreign debt is access to cheap credit from multilaterals.

Organizations such as the International Monetary Fund (IMF), the Inter-American Development Bank (IDB) or the World Bank have lent Ecuador funds at an average rate of 1.9%

There is still onerous debt

China still holds an onerous debt for Ecuador, not only because the interest it charges for financing is high, but also because of the terms.

Ecuador ‘s debt balance with China amounts to $4.78 billion as of February 2022; about 58% of these obligations, that is, $2.811 billion, mature in 2024 and 2025.

In addition to a short maturity term, these debts for $2.811 billion have the highest interest rates that Ecuador pays to China, since they range from 6.20% to 7.25%.

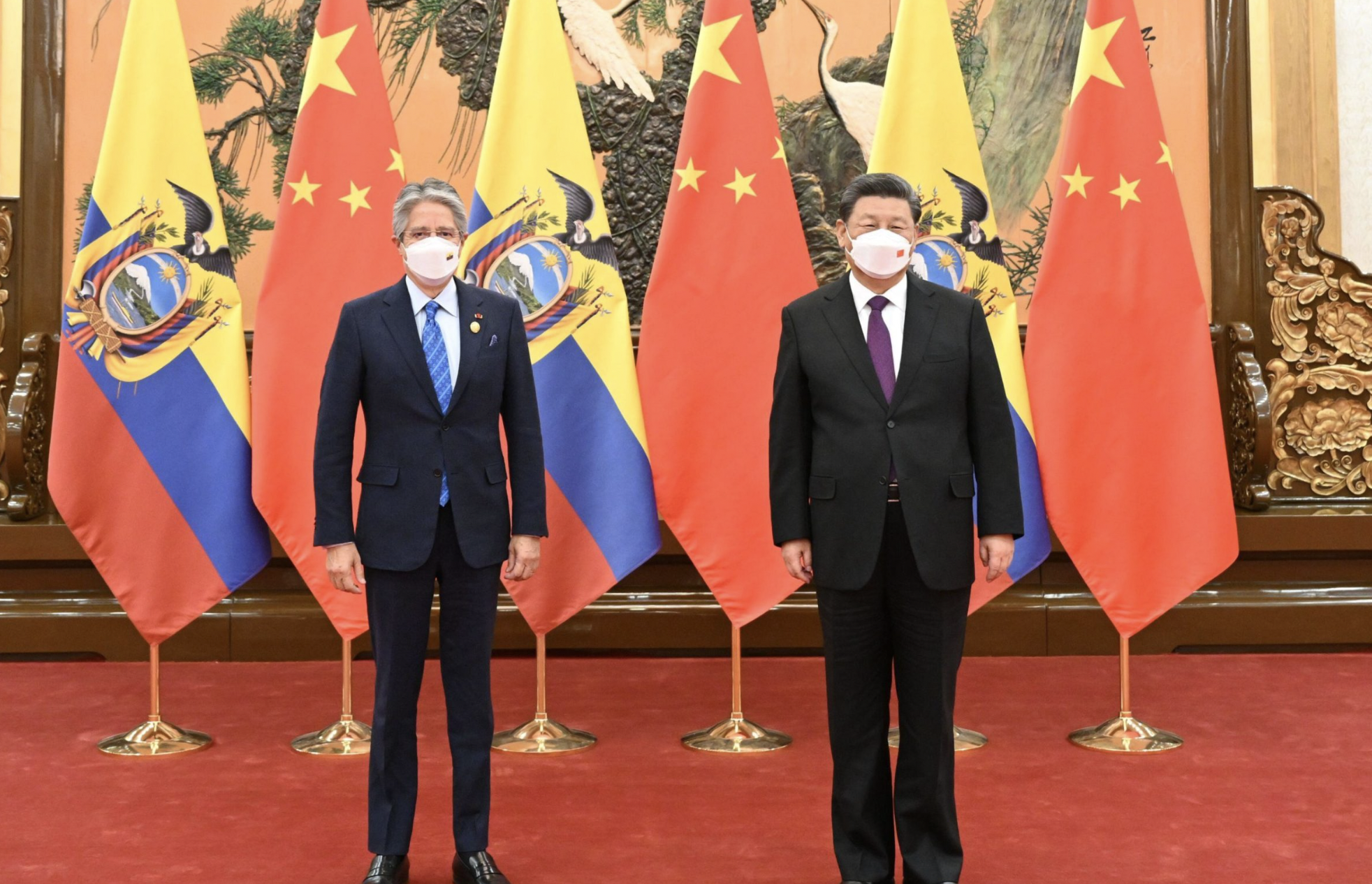

To ease the payment of obligations, Ecuador began a debt renegotiation process with China in April 2022.

The debts also have commitments to sell oil to China in the long term attached to them, which implies higher costs for Ecuador, says Fausto Ortiz, former Minister of Finance.

There are three current contracts between Ecuador and the two largest state oil companies in China: one with Unipec, a subsidiary of Sinopec, and two with Petrochina, a subsidiary of the giant CNPC.

These contracts commit Ecuador to deliver 121.4 million barrels of oil to the two companies between 2022 and 2024.

Ítalo Cedeño, Manager of Petroecuador, has pointed out that the conditions of oil sales contracts with Chinese companies can be improved.

The main proposal is to simplify the formula with technical and market variables, in order to avoid losses in the sale of oil with China, which, according to Petroecuador, are $3.60 per barrel.

IESS, another onerous creditor

Unlike external credit, the financial cost of Ecuador’s internal debt has grown from 5.8 % in December 2019 to 6.35% in February 2022.

One of the most onerous obligations is with the Ecuadorian Social Security Institute (IESS).

Thru February 2022, the State’s debt with the institute totaled $8.427 billion and had an average interest rate of 7.55%.

A good profile, with low interest rates and long terms, allows you to meet obligations without complicating other expenses that a State must make. For this reason, Ortiz says that the Government should make efforts to lower the internal debt, seeking better terms and rates with the IESS in new issues.

0 Comments