The outgoing government will deliver to the president-elect, Guillermo Lasso, a World Bank diagnosis to the IESS pension fund, the conclusion is that it needs an urgent reform.

The World Bank made a technical diagnosis of the situation of the pension fund (IVM) of the Ecuadorian Social Security Institute (IESS). There is a deficit that puts retiree benefits at risk by 2022.

The technical diagnosis warns that the pension fund has had a growing cash deficit since 2014, meaning that the contributions of IESS affiliates are lower than the payment of benefits to retirees.

The benefits are financed with the payment of contributions and the return on the IESS investments, but the “spread” is getting smaller and smaller.

The World Bank says that this deficit cannot be covered either by financing the pension fund reserves or by transfers from the Ministry of Finance, which are paid in arrears.

According to the technical study, the pension fund deficit will amount to $2.333 billion in 2021 and will reach $2.511 billion in 2022, the year when problems to cover pensions may begin, as shown in the following table:

| Results: Disability, old age and mortality insurance | ||||||||||

| In million of US $ | ||||||||||

| Detail | 2016 | 2017 | 2018 | 2019 | 2020* | 2021* | 2022* | 2023* | 2024* | 2025* |

| Contributions | 1.562 | 1.92 | 2.29 | 2.509 | 2.429 | 2.29 | 2.343 | 2.433 | 2.503 | 2.585 |

| Payment of Benefits | 3.277 | 3.65 | 3.905 | 3.976 | 4.324 | 4.623 | 4.854 | 5.063 | 5.235 | 5.379 |

| Basic IVM Deficit | −1.715 | −1.730 | −1.615 | −1.467 | −1.895 | −2.333 | −2.511 | −2.630 | −2.732 | −2.794 |

| Financing | ||||||||||

| Net Change in reserves | 1.621 | 1.64 | 1.479 | 335 | 1.055 | – | – | – | – | – |

| MEF Transfers | 94 | 91 | 136 | 1.132 | 841 | – | – | – | – | – |

Thru April 2020, the pension fund had a reserve of $7.2 billion, according to the IESS. But these resources are not liquid because they are invested in assets, such as domestic debt bonds and mortgage and unsecured loans, to name a few.

“The pension fund cannot be financed for long term because there are no resources in the reserves of the IESS system,” according to economist Augusto de la Torre, one of those responsible for the World Bank study.

For this reason, the World Bank diagnosis warns that transfers from the Central Government to the IESS are key, especially the payment of the 40% contribution from the State for retirement pensions. If the Ministry of Finance had not made money transfers to the IESS for 2020, the Institute would not have been able to cover its cash deficit for the year.

In a hypothetical scenario proposed by the World Bank, if the Government does not transfer more than $1 billion per year, the liquid reserves of the pension fund will be exhausted in less than two years (2022) and it would not be able to cover the benefits of retirees.

One of the problems in transfers from the Central Government is the constant arrears. For example, in 2021, the Ministry of Finance approved a budget of $1.477 billion for contributions to retirees, but as of March it had made no disbursements.

Not enough contributions

The financial problems of the pension fund also originate in the fact that the benefits of the retirees are greater than the contributions of the affiliates to the Institute, according to the World Bank.

“There are not enough contributions to finance retirees because the aging of the population or life expectancy increased,” says one of the conclusions of the multilateral organization’s diagnosis.

Thru 2018, a retiree was supported with the contributions of eight active members, but in 2020 that reality changed. Now there are only five contributors to fund for each retiree. And in 2040 there will only be three active affiliates financing payments for each retiree, according to the World Bank.

Reform cannot be postponed

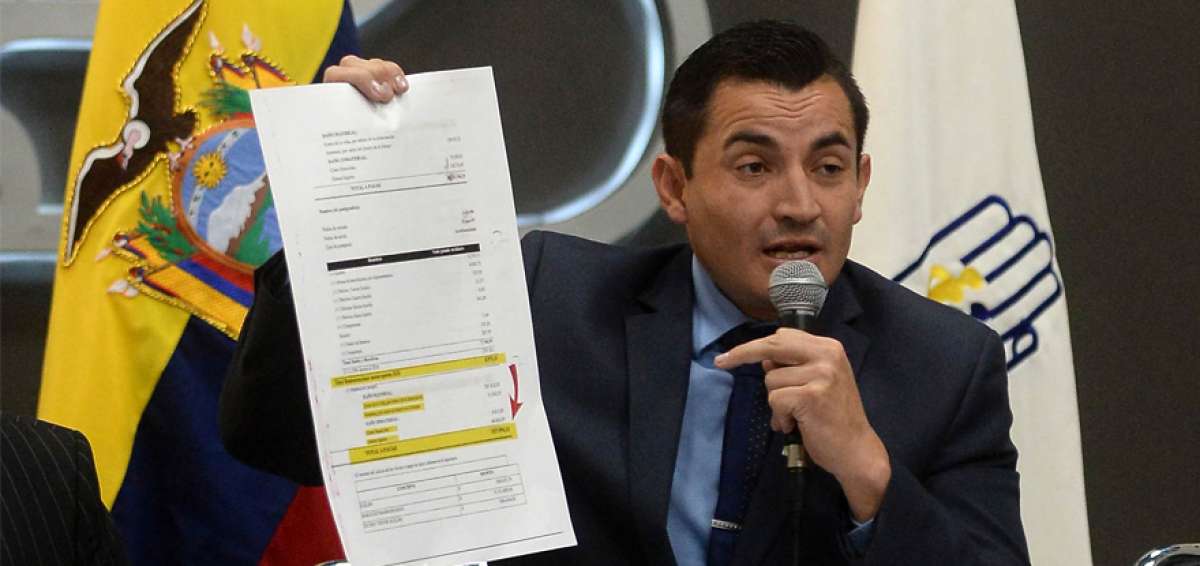

The Minister of Economy, Mauricio Pozo, says that the World Bank diagnosis will be the only input that the government of Lenín Moreno will leave to the president-elect, Guillermo Lasso, to promote a reform of the social security system.

Social security reform is one of the structural goals of the agreement between Ecuador and the International Monetary Fund (IMF), to make the system viable in the future. Pozo said that the reform should also aim to correct other problems that the IESS has, such as health care.

Heinz Rudolph, Chief Financial Economist at the World Bank, said that the reform should modify the corporate and administrative governance of the IESS and improve the management of the assets of the Bank of the Ecuadorian Institute of Social Security (Biess).

“Without reform, the pension deficit will take a growing slice of tax revenue or drastically reduce fiscal allocations for other priority expenditures,” Rudolph warned.

0 Comments