This article is unlocked

If you enjoy this article, consider subscribing to gain access to weekly reports on Ecuador’s economics, politics, crime and more.

The ECB had said in January—before the virus outbreak and the plunge in the price of crude, Ecuador’s main export—that Gross Domestic Product (GDP) would likely grow 0.7% this year after a modest expansion of 0.1% in 2019.

Last week, the ECB presented new projections based on scenarios that might happen this year post pandemic. In its most optimistic scenario, the central bank calculated that the country’s GDP would fall to 7.3%. In their most pessimistic projection, they said Ecuador could see a 9.6% fall in its GDP.

The International Monetary Fund (IMF) projects a contraction of the country’s GDP by 6.7% in 2020.

In 1999, during the country’s banking crisis, GDP contracted by 4.7%. Since the country chose to drop its Sucre currency and move to dollarization, the strongest recession it has seen was in 2016, when GDP fell 1.5%, after the drop in the price of oil.

All of these projections are the result of falling oil prices earlier in the year followed by the national health emergency that let to almost three months of confinement, partial paralysis of a good part of the production sector and commercial activities, and reduction of the demand for Ecuadorian products abroad.

When the health emergency was declared last March, the Government said that the economic impact could be between 6% and 7% of GDP.

Santiago García, professor at the Central University, points out that the economy has been struggling since 2016. He adds that this year, the main impact on GDP will be due to the fall in consumption and the cut of $1.3 billion in public works.

The ECB estimates that this year public spending will decrease by 5.6% due to adjustment measures. In contrast, public and private investment will drop at least a total of 14% in 2020.

What industries suffered the most during the health emergency?

Overall, the largest economic impact in Ecuador from the health emergency was in the production sector. Both private unions and the government agree that this sector lost close to $12.5 billion.

In fact, according to the Federation of Ecuador’s Chambers of Commerce, close to 70% of the production sector was shut down during the pandemic.

Of further concern was that even in the 30% of companies that continued to produce in the midst of the emergency, they did so with fewer workers, fewer customers and more stringent and costly biosafety requirement. This means that even in those industries continued to export product (e.g., bananas, cocoa, shrimp, fish), their distribution was much lower and was done at a higher cost.

According to Felipe Ribadeneira, President of the Ecuadorian Federation of Exporters (Fedexpor), all exportable supply was affected by the weakening of international demand and the problems of reducing operating capacity in industries.

Before this global pandemic, Ribadeneira says the export sector maintained an annual growth projection that exceeded $2 billion; now they project a fall of 10% annually.

José Antonio Camposano, President of the National Aquaculture Chamber, points out that the seafood industry went from sustained growth of 28% per month to -2% in March, 4% in April, and a loss of at least $162 million. This was despite the increase of 54 million pounds exported from January to April, adding 483 million in total, equivalent to $1.22 billion, 13% more volume and 8% more turnover versus the same period in 2019.

Fish, the third highest exported product, had a drop of almost 7.63% from January to March.It did not stop producing, but it did slow down by almost 50% during the quarantine, says Bruno Leone, President of the National Chamber of Fisheries.

For example, tuna processors in Guayas, where around 50% of total production is generated, reported a 50% to 60% reduction in capacity during April. In the case of Manabí, where the outbreak was less severe, there was a 30% reduction in production capacity.

Unlike the international market, consumption within the country grew by 20%, especially during the first weeks of isolation.The priority of the families during the quarantine was to stock up on non-perishable foods.In the first month of confinement, sales of canned fish in supermarkets shot up to 137%.

Christian Wahli, President of the National Association of Food and Beverage Manufacturers, says production was affected by various factors such as logistical difficulties, biosecurity measures, and the redesign of workflow to provide to the required distance in the production lines.Demand was also impacted by various situations, such as economic problems, fewer places to buy product (closure of neighborhood stores), curfews and restricted circulation.

“There were [some] winners in categories such as preserves, pasta, and losers who are mostly impulse products (such as candy, ice cream, etc.), whose highest sales are on the street, there the losses can be estimated in some cases [to be as much as] 80%,” said Wahli.

However, the high demand for some kinds of food does not equate to more profits, since it was mostly the basic products that were most sought after and “are not those with high margins, and if there was high demand in these categories, the economic performance has not been immense,” concluded Wahli.

At a time when the country’s cantons are beginning to relax confinement restrictions, Pablo Zambrano, head of the Chamber of Industries and Production (CIP), points out that a distinction must be made between “reactivation” and “recovery.”

The productive sector is reactivating with the partial lifting of restrictions, but he says recovery could take 18 months or more.

Luis Naranjo, Economic Chief of the Quito Chamber of Commerce (CCQ), says the real problem with predicting how long recovery will take is that no one knows how long the country will need to stay under “yellow light” epidemiologic restrictions, and how consumer behavior will react to that.

How bad is Ecuador’s deficit now?

Facing serious declines in GDP, Ecuador is now faced with trying to borrow more money to aid in its recovery from the impacts of the health emergency, and with seeking help to refinance its current debt load.

Ecuador has been buckling under its $58 billion debt burden which has been worsened by the coronavirus crisis. Last week, President Lenin Moreno said that the government would renegotiate its debt load, which would save an estimated $1.3 billion in interest payments.

Coupled with the fall in oil prices (and the rupture of two pipelines that occurred in April; these lines reopened last week), Ecuador is also expecting a sharp drop in tax revenue. Moreno says state income will likely decrease by $8 billion due to the impact of the coronavirus.

The President addressed the nation last week and explained that the government had been carrying a $7 billion deficit that they managed to reduce to $4 billion. He said with that added to the loss in revenue, the country is currently facing a deficit of about $12 billion in 2020.

The President said that budget cuts from recently announced measures will free up about $4 billion to be put toward the deficit. The rest is going to have to come from loan refinancing savings and more “access to international credit; we had even talked about the exceptional loan for which we are going to the International Monetary Fund.”

Moreno also discussed the immediate “special contribution” that is being asked of people earning more than $5,000 per month. He said this will be an advance on income tax. The “special contribution” will also be required from companies who have not seen their profitability decline due to the health emergency.

During his address Moreno also announced that an advisory council was formed to provide input on decisions of economic matters. He stressed that the council is purely advisory and that all economic decisions will still be made by the government.

Moreno also addressed calls for the impeachment of Ecuador’s Economic Minister, Richard Martínez. He called for calm and said that the economy needs stability.

“Our Ecuadorian economy, you know it, is fragile and it is torn between life and death and we cannot put it at greater risk. Please, gentlemen, assemblymen, I call responsibility for the emergency that the country is experiencing,” he said.

Refinancing the debt to happen quickly

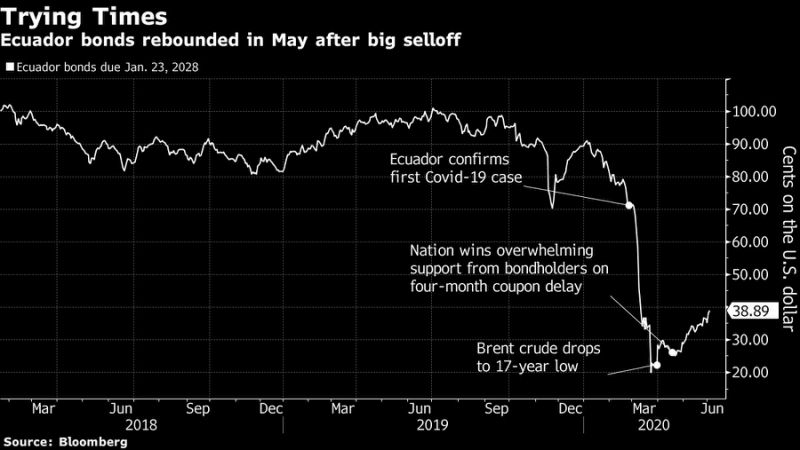

Last week, a group of investors that hold the majority of Ecuador’s outside debt had talks with the government to work out a restructuring of its debt. The group represents Ecuador’s bondholder base. The group said they “are sensitive to the challenges that Ecuador is facing.”

Nonetheless, they are working with the government to make sure that all bondholders are protected in any “re-profiling effort.”

Ecuador’s Deputy Finance Minister Esteban Ferro kicked off negotiations through a video conference where he outlined Ecuador’s situation and their strategy for debt management.

Ferro says that the goal is to be able to offer all bondholders and other investors an exchange offer by the first week of July. [In April, creditors had agreed to defer taking payment on Ecuador’s bonds until August to provide time for negotiations.]

The minister also made it clear that the country is still facing a $3.5 billion funding gap for 2020, and that while the government has made significant cuts to lower its deficit, any further fiscal consolidation would be limited in the short term as the country slowly reactivates its economy.

For now, Ecuador is seeking immediate liquidity relief “by way of reduced coupon payments in the short term followed by gradual increases and no principal amortizations in the short term.”

He added that in the medium term, Ecuador has to lower its gross financing needs to less than 6% of GDP. This is the threshold set by the IMF.

Ferro broke down Ecuador’s current debt as follows:

- $12.3 billion (23%) to multilateral lenders at an average rate of 3.8%.

- $6.5 billion (12%) in bilateral debt, composed mostly of debt to China at an average rate of 4.2%.

- $17.7 billion (33%) in international bonds, carrying an average interest rate of 8.7

- $13.3 billion (25%) local debt

- The remaining debt is domestic debt of over $6 billion.

Ferro said the country has secured $3.4 billion in funding for 2020.

0 Comments