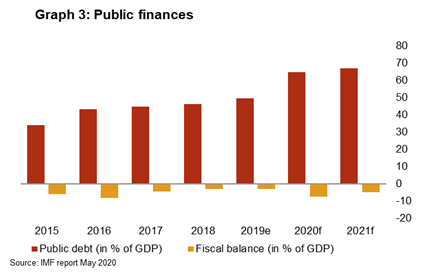

On an economic scale, the pandemic year can be baptized as the year of debt, both because of its growth and because of the importance it represented in the movement of the economy. The public debt of Ecuador grew by 10% of the Gross Domestic Product (GDP). With the health crisis came the paralysis of economic activity and with it the fall in tax and oil revenues. To compensate, it was necessary to resort to a greater debt.

In January 2020, the debt was $58.553 billion, which represented 53.39% of GDP ($109 billion); in January 2021, the debt reached $63.885 billion, or 63.37% of GDP ($100,000 million).

According to data from the Minister of Economy and Finance, Mauricio Pozo, current income (related to taxes) went from $23 billion expected, to $18 billion effective; capital income (related to oil) went from an expected $2.7 billion to just $565 million for the year.

Thus, financing was the way out. While initially it was expected the government would need $8.851 billion, it ended up requiring $11.149 billion.

With such an impact, “we had to resort to international aid, otherwise the crisis would have been unmanageable,” in addition to the health problem there would have been a stronger economic problem, said Pozo.

Jaime Carrera, Executive Secretary of the Fiscal Policy Observatory (OPF), says that the growth in debt to 63.3% of GDP is due to two factors: first, the increase in the deficit (gap between income and expenses), and second, the change in the calculation of GDP, which when contracting in 2020 and being compared with the volume of debt, gives a greater result.

According to Carrera, in the pandemic what has flowed steadily are the resources of the multilaterals: the International Monetary Fund (IMF), World Bank (WB) and Inter-American Development Bank (IDB), in various magnitudes. Carrera says that a special characteristic in this period of crisis has been that the multilaterals had placed a lot of emphasis on the fact that resources have to go to loans and certain social aid.

Carrera believes that unfortunately, what has not worked, both due to the pandemic and due to lack of government management, has been the aid to small, medium-sized and other companies, to whom only limited resources have been sent.

He said that the Reactívate fund was created, but the money arrived sporadically, mostly because of the strict requirements that had been put in place to receive the loans.

According to Minister Pozo, although the debt balance is now higher, it is important to see that its structure is better, with lower interest rates and longer terms. This is because a large volume of debt came from the multilaterals.

Looking at the debt structure as of January, the external debt amounts to $45.2 billion, while the internal debt (bonds placed in IESS, to other public financial entities, Central Bank, GAD, accounts payable) reaches $18.685 billion.

Regarding the internal debt, a significant rise was because by January the Government already accumulates debts to pay, from the previous year and this year, of $1.9 billion, says Carrera.

For 2021, the financing flow has been low. To date the government has only collected $180 million, so certain liquidity problems are already reflected, says Carrera.

The arrival of about $450 million from the IMF was expected in April, however, because the Dollarization Defense Law has not yet been passed (a requirement from the IMF), the Government has had to look for other financing options, which are not yet certain.

18 types of bonds for $1.045 billion reached vulnerable sectors in the pandemic

Some 18 kinds of bonds have been issued by the Government in the year of the pandemic, in order to cover the needs of vulnerable sectors. These 18 vouchers are part of those that are already delivered normally, and others created precisely by the health emergency. The amount of aid delivered in 2020 was $1.0454 billion, according to the Minister Pozo.

The minister stressed that in this year of the pandemic, the design of social protection policies have directed resources to the most vulnerable sectors. This year, in addition to the bonds such as Joaquín Gallegos Lara, Human Development with a variable component and My Best Years, bonds were created such as the Health Emergency, Family Protection, femicide bonus, nutritional support, and entrepreneurship promotion, among others.

For this year, the Government has announced the delivery of more bonuses (for the unemployed $500 and for public employees on the front line of combat against COVID-19) but has not yet managed to fulfill the offer. Pozo commented that this is a legal problem that needs to be resolved.

According to Carrera, the delivery of this aid, sponsored by multilateral organizations, is positive, since the pandemic has thrown millions of Ecuadorians into poverty, who with the bond can manage to recover liquidity, and reinvest it in the economy. He says that the issue of delivering $200 to frontline servers has a legal problem, which is the fact that they cannot receive bonuses or compensation.

On the subject, the Minister of Labor, Andrés Isch, explained that the first-line bonus would be considered an extraordinary remuneration and that of the unemployed would be an investment expense.

0 Comments