The president-elect has said that he will present his reform on the night of his first day in office.

President-elect Guillermo Lasso’s first announcement on tax mattes has gathered both support and questions. Analysts, experts and the representatives of the business sector feel the topic needs to be raised, but all agree that tax cuts are only one part of a comprehensive reform that must also consider how to compensate for the reduction in revenue due to the proposed rebates.

This week, Lasso made an outline of what his tax reform would be, which he said he would present the night of his first day in office. In an interview with CNN, he outlined four specific points: the elimination of the 2% income tax on micro-businesses; the reduction of the value added tax (VAT) during four holidays in the year, to support the tourism sector; the gradual reduction of the foreign currency outflow tax (ISD); and greater efforts to combat tax evasion.

Lasso clarified that his goal is not to create or increase the current tax rate. However, he said that he knows the private sector and that it is neither acceptable nor logical for businessmen to report losses for several years and thus not pay taxes.

The proposal to not create taxes and rather to lower them could be viable, according to Jaime Carrera, Executive Secretary of the Fiscal Policy Observatory (OPF). However, he warns that Lasso must find a way to compensate and even increase the collection of taxes by at least $1.5 billion, as the Intercultural Education Law that was just approved gives a 30% increase in the wage bill for teachers.

Carrera says that the elimination of the 2% IR for micro-businesses is a good move, since it is a tax that is levied on sales when instead it should have been a tax on profits. Phasing out ISD is a positive move since it will open Ecuador to more foreign investment, however, it represents about $250 million less in tax revenues each year.

He added that to compensate for the tax cuts, tax exemptions should be eliminated. He said that there is an important need to work on tax evasion, since it represents $4 billion in VAT and income. “Without raising taxes, the tax base can also be expanded,” he said. Carrera believes that the approach that Lasso is taking means that the possibility of an increase in VAT is somewhat remote.

The president of the Ecuadorian Business Committee (CEE), Felipe Ribadeneira, agreed with the points raised by the President-Elect, but added that the productive sector is working on a simplified tax reform proposal that they hope will be considered by the new government. The proposal will be delivered in a week and a half. Ribadeneira also said he agreed with the elimination or reform of the 2% income tax for micro-businesses. He felt that this should have been voluntary and not mandatory.

Regarding the lowering of VAT for four holidays, he said that it would be important to look at the reform text, and that everything that is done to reactivate tourism and restaurants, hotels hit by the pandemic is positive. However, he feels that it will not be enough.

As for the ISD, Ribadeneira said that the gradual reduction does not need to go through the Assembly, since the Economic Transformation Law already contains the possibility of reforming it via executive decree. He feels that the ISD has been a senseless tax that directly affects productivity, since imported raw materials and capital goods are taxed.

Ribadeneira said he shared Lasso’s position against tax evasion. “A good businessman, with all the letters of the word, must make a correct payment of taxes,” he said.

Santamaría Napoleon, a tax lawyer, said that the tax cut proposals are being rushed, and that the President-Elect would be going against the world trend that seeks rather to create wealth taxes. Regarding the ISD, she said that importers already have this payment incorporated into their costs, so that such reduction would not benefit the consumer. However, she suggested that a differentiated reduction of the ISD be made, depending on the products. She also argued that the elimination of the tax, by itself, does not attract investment.

The tax lawyer added that there are 43 tax exemptions in the Ecuadorian tax system, but foreign investment still isn’t coming to the country.

“It is not true that a strong tax burden scares the investor away, and that a weak one attracts it.”

She feels that what generates more investment is political stability and good profitability. She also believes that VAT refunds to Decentralized Autonomous Governments should be reviewed, which in her opinion do not follow a correct tax policy.

Regarding VAT, she feels that the proposal to lower it on four holidays can help, but that there should be a differentiated VAT, in which it is lowered on products that can support productivity, with a higher one for products of luxury. As for tax evasion, she proposes that it can be better controlled, and one option would be to create a single tax authority and not have it divided between SRI and Customs.

IMF program raises tax reform

Ecuador signed a financial agreement with the International Monetary Fund that proposed the delivery of $6.5 billion over 27 months; the first $4 billion was already received in 2020. An additional $1.5 billion is expected in 2021, however, it depends on whether the new Government wants to continue with the current agreement, which among other issues, proposed that a tax reform be carried out in 2021. The idea was that by 2022, it could come into effect and an additional $2 billion could be collected to lower the fiscal deficit. One of the suggestions was to increase the VAT from 12% to 15% and withdraw certain exemptions and tax refunds.

Tax collection fell in 2020

Ecuador’s tax collection in 2020 was $12.382 billion, a low figure compared to 2019, when $14.268 billion was collected.

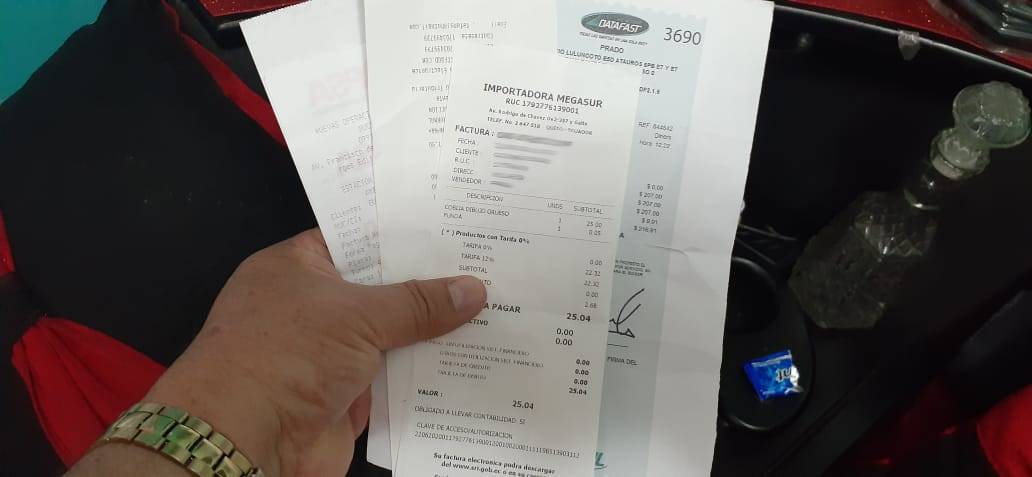

Approximately $5.506 billion of that was related to VAT collection in 2020. Again, a low amount compared to 2019, when is reached $6.685 billion. The ISD accounted for $964 million of revenue in 2020. The 2% IR for microenterprises came to $8.04 million in the first quarter of 2021.

All of these numbers become very important when analyzing how Lasso’s proposed tax cuts will impact the State’s budget for 2021 and beyond.

Lasso will announce “great projects of legal reforms” for his first 20 days of government

Aside from his tax reforms, President-elect Lasso said he has grand plans for change in the early days of his presidency. He has already had conversations regarding these plans with other political parties. Lasso added that he hopes to meet with the leaders of Pachakutik and the Democratic Left soon.

“I confirm that I have my hand extended, my arms open, my telephone open to talk with all the political sectors of Ecuador,” he declared.

He also stated that in the first 20 days of his government he will announce the major projects of “legal reforms that are required to transform the country.”

“We will announce them as we have “polished” projects. One thing is to prepare projects for a government plan and another thing is to polish the project to deliver it to the National Assembly,” he said.

In relation to the makeup of his cabinet, Lasso commented that his entire government team will seek gender parity, and have regional and indigenous peoples and nationalities, and Afro-descendants.

“We want the government team, not only the Cabinet, but senior officials to represent Ecuadorian society and the Ecuadorian concept of representation,” he said.

Lasso also announced that he had met with the vice president-elect, Alfredo Borrero, to outline the details of the vaccination process in the next administration.

During the electoral campaign, the Lasso-Borrero binomial promised to inoculate at least nine million people in the first 100 days of government using the centers of the Ministry of Public Health and the Ecuadorian Institute of Social Security.

Borrero shared with Lasso the information collected in countries such as the United States, Colombia and Chile, whose vaccination processes were inoculating a large number of people in recent months.

0 Comments