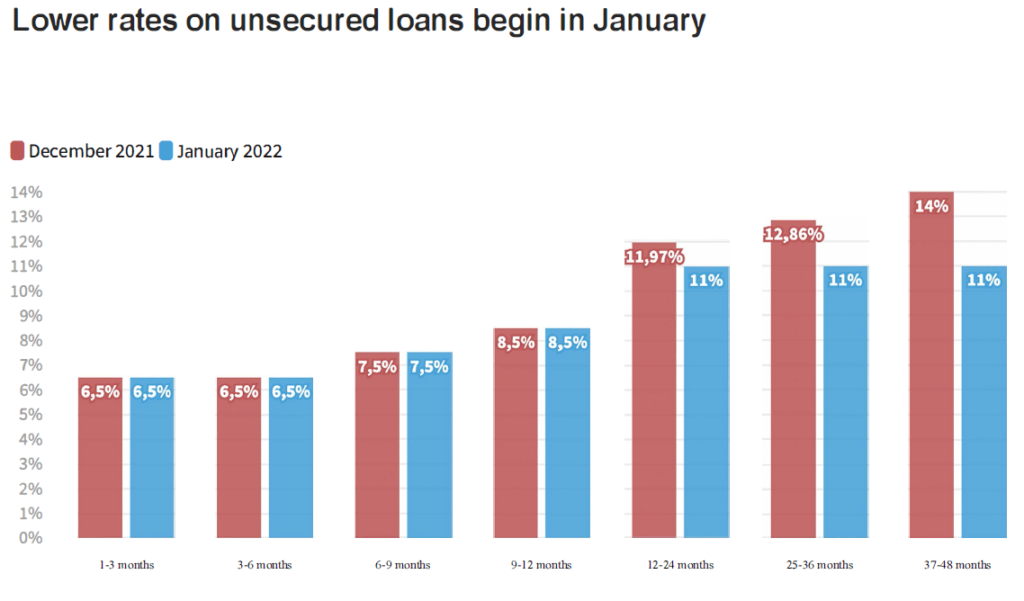

The current interest rate on unsecured loans with terms longer than 13 months varies from 11.97% to 14%. Starting in January 2022, it will drop to 11%. To offset the cost, the IESS explained that it will apply measures such as reducing the delinquency rate.

As of January 1, 2021, the interest rates charged by the Bank of the Ecuadorian Social Security Institute (Biess) for unsecured loans requested by members and retirees with a term of more than one year, will be reduced.

The benefit will be valid for new loans that are requested between January and June 2022.

For this consumer credit, the bank now establishes seven types of interest rates, which vary according to the term.

The longer the term of the unsecured loan, the higher the interest rate that affiliates and retirees who opt for this financing mechanism must pay.

These loans, which are delivered in terms of between 13 and 48 months, currently have interest rates that fluctuates between 11.97% and 14%.

Beginning in January, those loans with terms greater than one year will have an interest of 11%, said the president of the Ecuadorian Institute of Social Security (IESS), Francisco Cepeda, in a press conference held on December 23, 2021.

The interest for unsecured loans that have terms of between 1 and 12 months will remain between 6.5 and 8.5%, based on the term of the loan.

The chart below compares the current rates with the rates that will be in place beginning in January 2022:

“This is nice news for members and retirees. It is a significant drop so that they can start a business or refinance their debts, “said the president of the Ecuadorian Social Security Institute (IESS), Francisco Cepeda, during a press conference on December 23, 2021.

The goal is to reactivate the economy, Cepeda added.

According to Biess, members and pensioners use unsecured loans for the following purposes:

- Debt payment

- Vehicle purchase

- Travel expenses

- Investment for education (own or family)

- Acquisition of household goods

- Health expenses

- Housing arrangements

The maximum term of this credit is four years.

Discount will be evaluated

After the first six months, the Biess board will evaluate the new policy and decide whether to continue with the 11% interest rate for the three unsecured segments.

This strategy may change depending on how the bank is balancing out its costs, said Iván Tobar, Biess manager.

The financial institution plans to exceed $3.7 billion in placement of unsecured loans in 2022, a figure higher than the goal of $2.8 billion for 2021.

Cepeda justified the reduction of the interest rate of this financial product in order to “make efficient credit management.”

High delinquency

The President of the IESS reported that next year they will also review the credit manual to overcome “problems” in mortgage loans such as the high delinquency rate, which is 9%, triple the rate registered in private banks.

For example, the official spoke of promoting the restructuring and refinancing of home loan debt. He will also review other investments such as the acquisition of bonds.

“In this way, the levels of loss (in the Biess) would be reduced, which will help to compensate for the decrease in interest that is being done (in the unsecured companies),” said Cepeda.

According to the bank, the delinquent portfolio in mortgage loans exceeds $900 million, which Cepeda attributed to the economic effects of the pandemic.

The financial entity plans to deliver $750 million in mortgage loans in 2022.

Cepeda announced that they will seek to obtain resources of between $500 million and $1.5 billion to inject liquidity to the IESS through the monetization of Biess assets, whose investment portfolio reaches $20 billion.

Among the assets to be monetized is the portfolio of mortgage loans, unsecured loans and government bonds.

0 Comments