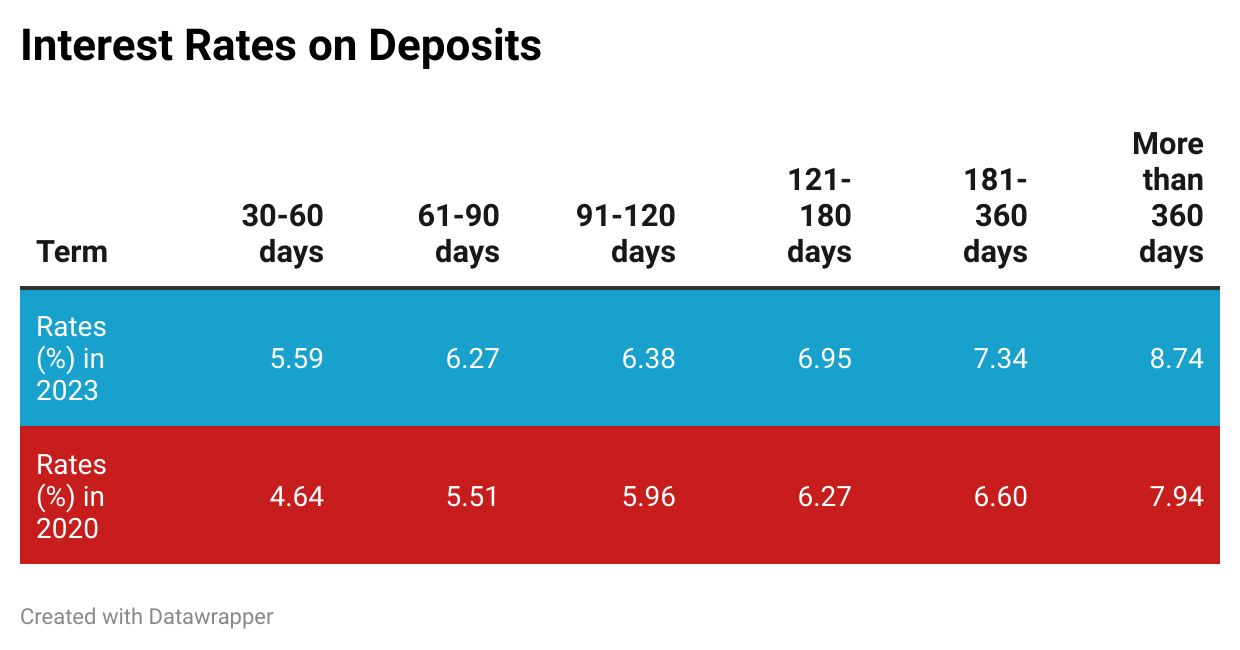

On average, customers who choose to deposit their money for a term of one year or more in April 2023 will be entitled to an interest rate of 8.74% per annum.

The interest rates offered by banks and cooperatives in Ecuador to those who deposit their money in fixed-term accounts or savings policies have reached their highest level since April 2020. According to the Central Bank of Ecuador (BCE), the average interest rate paid by these entities in April 2023 is 6.97% per year.

The longer the term of the deposit, the higher the interest rate. For deposits with a term of more than one year, the average interest rate is 8.74% per year. Those who open a fixed-term policy for six months in April 2023 receive an average yield of 6.95% per year.

In the financial sector, there are entities that allow individuals to invest in a fixed-term deposit for a period ranging from one month to over a year, with no minimum deposit amount required.

Highest rates since pre-Covid

These are record-high returns for savers that have not been seen since April 2020, when the country was hit by the Covid-19 pandemic. In the context of economic uncertainty, financial institutions needed to attract more deposits, which is why they paid an average of 7.24% to those who deposited their money in fixed terms in April 2020.

Money in traditional savings accounts generates an annual rate of 1%, on average, and the client can withdraw the money without any term restrictions, unlike fixed-term policies. However, some financial institutions are offering even higher interest rates for deposits in these types of accounts.

For example, Banco Pichincha offers the Flexible Savings Account, where the client sets a savings goal to be achieved within a specific period, and the entity pays a 5% annual return. Banco Internacional has a similar product, the Rentable Savings Account, which pays interest rates ranging from 3% to 5% per year.

Other institutions are offering prizes to those who open savings accounts and fixed-term policies in April 2023, a month when workers usually have more resources due to the payment of profits by companies. Banco Bolivariano holds weekly draws of $50 for customers who open savings accounts this month. Banco Guayaquil has a similar promotion that raffles $1,000 for 10 customers who take out policies. Produbanco is raffling $2,000 weekly among its clients who make increases in deposits in programmed savings accounts.

Banks need the money

The increase in interest rates offered by banks and cooperatives can be attributed to several factors. Although deposits in the financial sector have not decreased, their growth rate is slowing down. “That is why competition between banks and cooperatives has increased to attract more deposits,” says David Castellanos, a professor at the Simón Bolívar Andean University.

Entities need to capture more deposits because a good portion of the resources they have to disburse loans comes from depositors’ money. A slowdown in deposits could lead to a decrease in credit placement. According to data from the Association of Private Banks (Asobanca), there is already evidence of a slowdown in credit growth, especially in segments with less profitability for the institutions or with higher delinquency risks.

Another factor that has affected the liquidity of the economy is the drop in oil revenues due to price volatility. Additionally, there are fewer loan disbursements for the government after the end of the agreement with the International Monetary Fund (IMF), and private investment is declining due to economic and political uncertainty.

Financial institutions also tend to request loans abroad to provide credit to their clients in Ecuador, but international interest rates are on the rise. Asobanca’s executive president, Marco Rodríguez, explains that the United States Federal Reserve has increased interest rates to reduce inflation during 2022 and 2023, making borrowing abroad more expensive for banks.

Great but be careful with putting all your eggs in one basket, especially if it’s not with a big bank with a reliable record in the past decades

Deposits are insured up to $32,000. More than that, you need to move to another “tier.” There are three tiers… max all three for a total of $96k in insured deposits. Pull down almost $9000 a year in interest. You could pay for a nice rental with just that interest pulled out to another account as it is paid.

And that more than qualifies you for the Investor Visa as well… come and go to EC as much or as little as you like.

Hi, can u clarify one more time:

If I invest 32k to 3 institutions (totally 96) : 32 or 96 will be insured ?

Thank u

Did not know about tiers. I here of one that is paying 10.5% interest per yearly