This article is unlocked

If you enjoy this article, consider subscribing to gain access to weekly reports on Ecuador’s economics, politics, crime and more.

Great news, right? Well, in the short term yes. The renegotiated debt plans will help Ecuador get past its current economic crises and hopefully carry it thru to a more stable post-COVID-19 world economy. In theory, it will also help the country to reactivate the economy right now.

However, by doing so, Ecuador also extended the terms on the debt from six to 13 years.

So, is all this good or bad for the country?

Before we get to that, let’s look at how all of this has transpired over the last few months, because the path to get to this point has not been easy.

Ecuador begins move to restructure debt

Back in early July, Ecuador announced that it had been able to renegotiate the majority of its foreign debt being held by international bondholders. Its Finance Minister, Richard Martinez said that the country would be able to cut its debt payments and extend the maturities on its obligations.

“The negotiation process was intense, and we have tried at all times to protect the interests of Ecuadorians,” Martinez said. “It alleviates the weight of the debt in the years to come so that our country can have more resources for economic reactivation and social programs for the most vulnerable.”

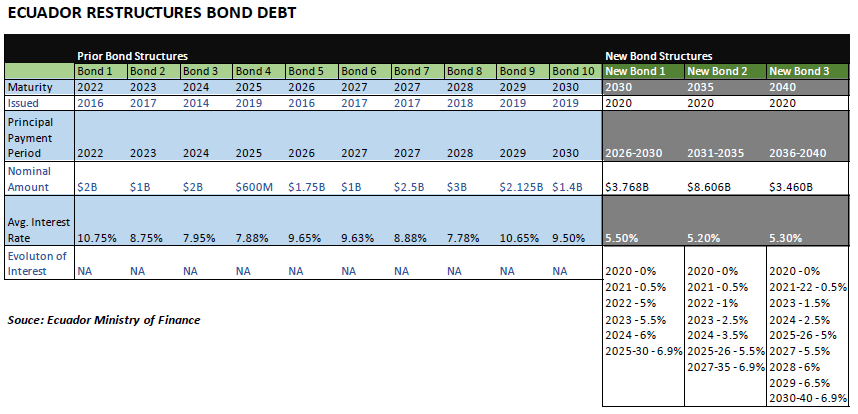

The negotiations with bondholders began in April. At stake was $17.4 billion in bonds that would be maturing by 2030, some with interest rates as high as 10.75%.

Martinez said that the country had reached an agreement with four investment management firms that controlled more than half of the country’s foreign bond debt. What this group agreed to was to:

- alleviation in scheduled payments,

- capital reductions,

- longer maturities,

- lower interest rates and

- longer grace periods.

Martinez said that this year, Ecuador would not need to make additional payments and that $11 billion that was due in 2025 was being extended. He also said that existing debt capital was being reduced from by $1.6 billion, going from $17.4 billion to $15.8 billion.

Interest rates were also being lowered from an average of 9.2% down to 5.3% and maturity dates would be extended from an average of 6.1 years to 12.7 years, with bonds maturities now extending out to 2040 (originally these bonds were due no later than 2030).

On top of all of these concessions, bondholders also agreed to grace periods on both interest and capital debt; Ecuador was given a grace period of two years on interest and would not need to make capital payments for the next 5 years. That means between now and the last quarter of 2021, Ecuador will only have to pay $79 million, versus $2.9 billion in interest and capital that was coming due.

“We have managed to get bondholders to agree to wait until we recover,” Martinez said.

Critics pointed out that the country still had to get the rest of the bondholders on board. Some of the notes require a 67% approval while others (2024 bonds) require 75% of bondholders to agree to the restructuring.

Martinez said that the support of the IMF would play an important role in securing the support of the remaining bondholders.

“We are working with the IMF to build a framework for Ecuador’s debt that has a more sustainable trajectory,” he said.

Ecuador’s total debt is approximately $58.4 billion. About one-third (32%) is held by foreign bondholders, 23% by international organizations (such as the IMF), 10% by other governments, 4% by banks and 29% by the Ecuadorian government itself.

Foreign bondholder group sued Ecuador to stop renegotiations

After announcing that it had been able to renegotiate the majority of its foreign bond debt, Ecuador ran into a lawsuit filed by two investment firms who hold a small minority of its notes.

Contrarian Capital Management and OGM sued Ecuador on July 29, 2020, saying that the country had used coercive” actions to try to force the bondholders to agree to consent solicitations to renegotiate the debt it held. Ecuador’s Ministry of Finance rejected the suit saying that it “is completely far from the truth.”

Ecuador also said that the legal actions initiated by these two groups are an “openly shameless” attempt to set aside the collective action clauses expressly agreed to in the original bond contracts, which provide for the consent of a substantial percentage of the holders.

Finance Minister Martinez also claimed that these two groups of investors had the same opportunity to participate in the process as the other bondholders, and that in the midst of an unprecedented economic, health and humanitarian crisis in the country, they were demanding preferential treatment in the restructuring of the bonds .

The lawsuit threatened to derail Ecuador’s efforts to work its way out of its current financial troubles, with a vote by bondholders scheduled for August 3rd.

“We will not give in to their attempt to boycott the process,” warned Martinez.

He added that Ecuador would not be pressured by the “aggressive attitude adopted by Contrarian and GMO, funds that have a minimum position of the total amount of the bonds involved in the negotiation,” and said that their legal action was an attempt to gain additional compensation “above what was negotiated in good faith with the majority of its largest creditors. “

Together, Contrarian Capital Management and OGM hold 3% of Ecuador’s foreign bond debt.

Judge throws out minority bondholder lawsuit

On July 31st, after being thrown a last-minute curveball in its move to renegotiate its foreign bondholder debt, Ecuador got positive news from a Southern District of New York judge: minority bondholders would not be allowed to hold up its renegotiated debt vote

Federal judge Valierie Caproni, in Manhattan, “denied a request made by two international investment firms (OGM and Contrarian Capital Management LLC), for a temporary restraining order that blocked Ecuador’s plan to restructure $17.4 billion of sovereign debt.”

Caproni’s ruling paved the way for Ecuador to continue with the next step in the process, a vote by bondholders to be held on August 3rd

Minister of Economy and Finance, Richard Martínez, said that “the fact that the judge of the Court of the Southern District of New York has rejected the petition to suspend the process of restructuring our bonds, rejecting the arguments presented by two investment funds that tried to block the process, it is a great step in the negotiation of Ecuador’s debt.”

He added that Ecuador would continue to seek majority support for the country’s proposal, which, “as has been said, aims to ease the flow necessary to focus on economic revival and protection of the most vulnerable.”

The quick judgement was a huge relief to Ecuador who had argued that a significant delay could lead to a “massive cascade default.”

“Justice prevailed and that is good for everyone. A blocking of the process would have been very negative,” added Martínez.

Caproni disagreed with the funds’ claim that Ecuador lied when it denied, in a press release, that its offer to investors was “coercive.” The judge said, “No one is being compelled to comply with the public offer.”

Ecuador had entered into a good faith negotiation in April with bond holders of $17.375 billion debt. It presented its formal proposal on July 20, with the support of 53% of the bondholders of the debt; an additional 7% of bondholders offered their formal support.

Bondholders agree to restructured debt plan

Last Monday Ecuador was able to finally breathe a sigh of relief when it announced that foreign bondholders had agreed to restructure $17.4 billion worth of debt.

Under the new plan, Ecuador will be swapping out bonds that were set to mature between 2022 and 2030 with new ones that will mature as far out as 2040.

“Great news for Ecuador!” President Lenín Moreno tweeted last Monday morning. “We reached the necessary majority to renegotiate of foreign-debt bonds. With this, we liberate resources to reactivate the economy.”

After the courtroom drama that almost stalled the entire effort, 98.2% of the bondholders of $15.3 billion of the debt and 95.4% of the bondholders who held $1.89 billion in debt agreed to the restructuring plan.

Ecuador said that it planned to have all of the debt exchanged by August 12th.

China agrees to let Ecuador postpone debt payments for one year

After successfully getting its foreign bondholders to agree to restructure its capital and interest debt, Ecuador was also able to reach an agreement with China to postpone paying $417 million that was due over the next 12 months.

Last Wednesday, Ecuador’s Finance Ministry announced that the China Development Bank (CDB) had agreed to modify Ecuador’s debt payments for the remainder of 2020 and all of 2021. Originally, Ecuador had been scheduled to pay $167 million thru the end of 2020 and $250 million by July 2021.

Under its new terms, Ecuador will pay CDB the entire $417 million in 11 quarterly payments of approximately $38 million; these payments will start in the last quarter of 2021 and end the second quarter of 2024. The debt is the result of a credit line that CDN extended to Ecuador in April 2016 (at a rate of 7.16%). Essentially this means that Ecuador will have “debt relief” of $356 million over the next 18 months, during a time while it tries to stimulate the reopening of its economy.

“It will always be relative for someone to say that this is little or a lot, but for us, it is good news,” said Finance Minister Richard Martínez. “It’s an important step in getting the relief that we need. Plus, this is something you must view holistically, for, on the one hand, we are seeking relief and, on the other, new financing, so there must be an equilibrium.”

Another aspect of the agreement allows Ecuador (thru Petroecuador) to sell 108 million barrels of oil—that had originally been meant to be part of the debt repayment—on the open market. If Ecuador chooses to do so, it may be able to get a higher value than was originally “allowed” in the loan agreement.

The end result favors Ecuador’s future

So, back to our original question, was all of this good for Ecuador? In the simplest of terms, yes.

The goal of the entire restricting project had been “to establish one profile of debt that will avoid the crises of future payment (default),” explained Finance Minister Martínez

Another reason was that Ecuador needed to show the world that it would not be defaulting on its loans. This was considered necessary to ensure that it would have access to capital in the future.

“Ecuador has made a great effort to fulfill its obligations and clean up its history of defaults,” and that it maintains “a process of debt restructuring in a correct and responsible manner,” said Government Minister, María Paula Romo.

If Ecuador had not been able to restructure its debt, the country would have gotten into a scenario where it would have been borrowing further to pay its current debts. This would have made it difficult to acquire funding in the international markets and would have meant that any capital it did acquire would have been at even higher interest rates.

In contrast to this, last week’s agreement means that instead of defaulting on its bonds, Ecuador may actually have its bond rating upgraded.

S&P Global Ratings said it would likely raise the country’s bond rating from “selective default” to between CCC and low B once the new bonds are issued. Even so, because of social, political and economic weaknesses (and the uncertainty of the effect the pandemic will have on the country in 2021), S&P does not foresee the potential for higher ratings in the near future.

The ratings group said that the price of oil and the country’s low flexibility in its monetary policies (due to dollarization) will continue to weigh on its rating in the future.

At the end of it all, Ecuador has managed to restructure its debt, relieve the pressure of payments for the next year, cut its average interest on its bonds by nearly 4%, and cut its capital debt by $1.6 billion. And, it’s managed to improve its bond rating in the meantime.

While by no means does this mean that Ecuador is out of its economic problems, its effort at restructuring its debt has been successful and will give it a greater chance to restart its economy over the next year.

0 Comments