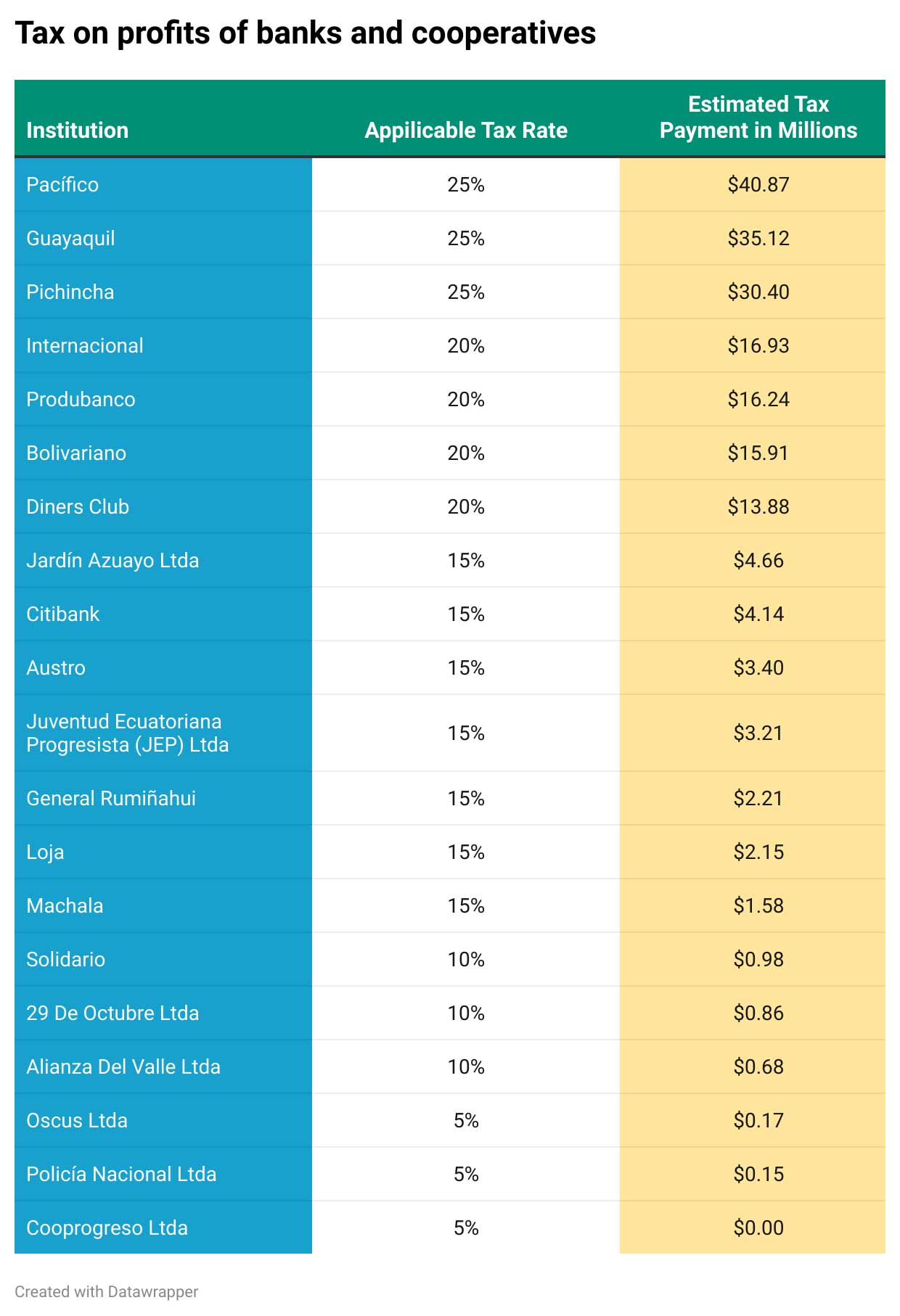

Under the Law aimed at addressing the armed conflict, banks and cooperatives are required to remit taxes ranging from 5% to 25% in May 2024, contingent upon their respective profit margins.

Banks and cooperatives in Ecuador are facing a significant tax burden, with more than $193.7 million slated to be contributed towards efforts to combat the internal armed conflict. This obligation stems from the implementation of the Law to confront the armed conflict, which became effective on March 12, 2024. Under this law, banks and cooperatives are mandated to pay a new tax, the rates of which range from 5% to 25% based on their profits in the fiscal year 2023. This tax is scheduled to be paid in May 2024, and it represents a substantial financial commitment for these entities.

In the preceding fiscal year, private banks in Ecuador collectively reported net profits totaling $737 million. Meanwhile, the largest cooperatives in the country accrued profits amounting to $114 million. Consequently, the implementation of this new tax is expected to generate approximately $184 million from banks alone, as projected by the Association of Private Banks of Ecuador (Asobanca). Additionally, the top seven cooperatives, which represent a significant portion of the cooperative sector, are estimated to contribute approximately $9.7 million in total.

How will the tax be calculated?

The calculation of the tax is based on the taxable profits earned by banks and cooperatives in 2023. Taxable profits are determined after deducting the percentage of participation paid to workers and before accounting for Income Tax. Entities with taxable profits exceeding $50 million will face the highest tax rates, ranging from 20% to 25%. Notably, among the financial institutions subject to this tax, 13 banks and 2 cooperatives are expected to bear the greatest burden. These include prominent names such as Pacífico, Guayaquil, Pichincha, Internacional, Jardín Azuayo, and JEP.

It’s worth highlighting the disparity between the tax obligations of financial institutions and those of non-financial companies. Unlike the Temporary Security Contribution (CTS), which non-financial companies are required to pay in March 2024 and 2025, with proceeds specifically allocated for expenses related to combating the armed conflict, the funds collected from banks and cooperatives do not have a designated purpose within the General State Budget. Furthermore, non-financial companies face a lower temporary tax rate of 3.25% and are projected to contribute significantly more, amounting to $325 million in March 2024.

Union claims tax us unfair

This discrepancy in taxation has raised concerns regarding fairness and equity among different business sectors. Asobanca has been particularly vocal in expressing these concerns, advocating for the application of principles of rational proportionality and equity across all sectors. The association has warned against the discriminatory nature of the new tax and emphasized the need for a balanced approach that considers the diverse economic contributions of various industries.

Additionally, there are apprehensions regarding the potential economic repercussions of the increased tax burden on banks and cooperatives. Asobanca has warned that the higher tax obligations could lead to a slowdown in credit activity in 2024. This could have broader implications for the economy, particularly in terms of access to financing for businesses and individuals.

While the implementation of the Law to confront the armed conflict represents a significant step in addressing internal security challenges, the associated tax burden on banks and cooperatives raises important questions about fairness, equity, and economic impact. As stakeholders navigate these complexities, there is a need for careful consideration and dialogue to ensure that the tax system promotes both fiscal responsibility and economic growth.

0 Comments